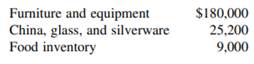

Stew and Brew have decided to lease a new restaurant. Rent for the building will be $3,000 a month to be paid on the first day of each month. They initially invested $225,000 of their own money, which was used in part to purchase:

Use straight-line depreciation over 5 years for furniture and equipment (no residual value). China, glass, and silverware are to be fully depreciated in Year 1. Sales are forecasted as follows for the first three months after opening:

![]()

Sales revenue will be 80% cash and 20% accounts receivable with the maximum credit period allowed of 30 days. Food cost of sales is expected to average 30% and all purchases will be cash. Wages and salaries will be $15,000 a month. However, in any month when sales exceed $60,000, additional staff will have to be hired, and the extra wage cost is estimated to be 20% of any excess sales. All salaries and wages will be paid in the month during which they were earned. Other operating costs are expected to be 10% of sales and will be paid in the following month. At the end of Month 3, Stew and Brew plan to pay themselves back part of their initial investment. This payment will be from any cash in excess of $15,000 at that time. In other words, they wish to leave only $15,000 in the restaurant’s cash account at the end of each three-month operating quarter.

Prepare

a. A budgeted income statement for each of the three months.

b. A cash budget for each of the three months.

c. A condensed balance sheet for the first quarter at the end of Month 3.

Fritz, the owner of the Ritz Cafe, needs an after-tax cash flow of $27,000 next year. Principal payments on loans are $42,000 a year, and depreciation is $21,000. Tax rate for the Ritz Cafe is 25%. Fixed costs (including depreciation) are $55,000, and variable costs are 30% of sales revenue. a. What level of sales revenue will provide Fritz with his desired cash flow next year? b. Prove your answer.