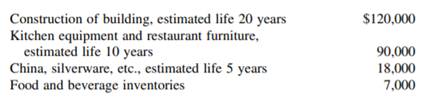

A new restaurant was incorporated on January 1, 0008. Forty thousand shares of stock were issued for $6.00 cash per share. The cash received from the sale of shares was used, in part, as follows:

The remaining cash was deposited in a bank account. The following estimates were made about the volume of business and operating expenses for the first three months:

a. Sales revenue: January $30,200, February $60,800, and March $90,400.

b. Sales revenue will be 55% cash and 45% credit; maximum credit to be allowed is 30 days.

c. Food cost and liquor cost will average 38% of total sales revenue. Forty percent of this cost each month will be cash; the balance will be paid in the month following purchase.

d. Wages and salaries: the fixed portion of wages will be $5,200 a month; the variable portion will be 30% of any sales revenue in excess of $25,000 a month. Total wages and salaries is the sum of the fixed and variable portions. Wages and salaries will be paid in the current month.

e. Other operating costs will be $3,800 a month, to be paid in the month following incurrence of the cost.

f. Depreciation for building, equipment and furniture, and china and silverware is to be calculated on a straight-line basis (no residual values). The annual depreciation amount must be prorated monthly to the income statements.

Note that, because of increasing sales revenue, a further cash investment in food and beverage inventories of $2,000 will have to be made in February, with another increase of $2,000 in March. This will increase total inventory investment to $11,000 by the end of March.

Required

1. A budgeted income statement for the three months ending March 31, 0008.

2. A cash budget for each of the first three months of 0008.

3. A balance sheet as of March 31, 0008.