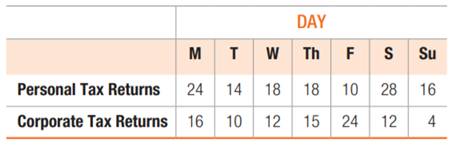

Little 6, Inc., an accounting firm, forecasts the following weekly workload during the tax season:

Corporate tax returns each require 4 hours of an accountant’s time, and personal returns each require 90 minutes. During tax season, each accountant can work up to 10 hours per day. However, error rates increase to unacceptable levels when accountants work more than 5 consecutive days per week.

Hint: Read Supplement D before doing this problem. Let ![]() number for each working schedule,

number for each working schedule, ![]() number for Tuesday through Saturday.

number for Tuesday through Saturday.

a. Create an effective and efficient work schedule by formulating the problem as a linear program and solve using POM for Windows.

b. Assume that management has decided to offer a pay differential to those accountants who are scheduled to work on a weekend day. Normally, accountants earn $1,200 per week, but management will pay a bonus of $100 for Saturday work and $150 for Sunday work. What schedule will cover all demand as well as minimize payroll cost?

c. Assume that Little 6 has three part-time employees available to work Friday, Saturday, and Sunday at a rate of $800. Could these employees be cost effectively utilized?